Detalhes

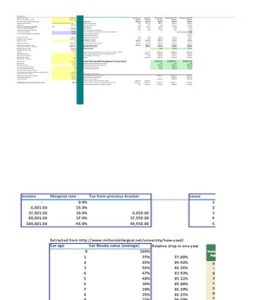

Maximum GST Claimable on MV & Car Limits Inc Luxury Car Tax

Jul 15, 2012 . Every year a maximum claimable GST amount is set by the ATO on motor vehicles. Car Limits 2012/13. Luxury car tax (NAT 3394) is currently .

http://www.njmandco.com.au/blog/130-maximum-gst-claimable-on-mv-a-car-limits-inc-luxury-car-tax.html

Produtos relacionados

western jewelry wholesale suppliers-

Luxury Car Tax - Wikipedia, the free encyclopedia

LCT is payable by businesses which purchase or import luxury cars, unless the . LCT is charged in addition to the Goods and Services Tax (GST), but it is not .

http://en.wikipedia.org/wiki/Luxury_Car_Tax -

importing a motor vehicle

Jul 12, 2012 . Pay customs duty, Goods and Services Tax (GST) and luxury car tax (LCT) where applicable and obtain customs clearance at the port of entry.

http://www.customs.gov.au/site/page4371.asp -

good paying jobs with no experience needed

Luxury Car Tax (LCT) Explained - Car Finance - Stratton Finance ...

Luxury Car Tax is applicable to most new and demonstrator cars where the price (including GST and excluding government fees and charges such as stamp .

http://www.strattonfinance.com.au/car-finance/learn/articles/luxury-car-tax-lct-explained.aspx

-

luxury apartments washington dc area

Common errors when claiming GST credits

Jun 24, 2011 . Can you claim GST credits for cars above the car limit? You cannot claim . GST and motor vehicles (NAT 4629); Luxury car tax (NAT 3394).

http://www.ato.gov.au/government/content.aspx?menuid=0&doc=/content/00196497.htm&page=4&H4 -

Luxury car limit 2010-11 released - Taxpayers Australia

Jun 17, 2010 . On 2 July 2010 a dealer supplies a car with a GST inclusive value of $66,000. As the GST inclusive value exceeds the luxury car tax threshold .

http://www.taxpayer.com.au/media/news/luxury_car_limit_2010_11_released.html -

loan payment calculator td canada trust

Luxury Cars - Eclipse Accounting Group, Chartered Accountants ...

A luxury car is a car that has a GST-inclusive value that is higher than the luxury car tax threshold ($57,180 in the 2010 year). You can not claim a credit for any .

http://www.eclipseaccounting.com.au/resources/library/luxury_cars___tax

-

NEW FINANCIAL YEAR TAX CHANGES & GST ON LUXURY CARS

NEW FINANCIAL YEAR TAX CHANGES & GST ON LUXURY CARS. 1/07/2011. The new financial year heralds the implementation of a number of tax changes .

http://www.boyceca.com/default.asp?pagetype=newsitem&menu=aaaaaf&id=EPZMQZ -

Guide to luxury car tax - Australian Taxation Office

Jul 27, 2012 . A luxury car is a car with a GST-inclusive value above the LCT threshold ( currently $59,133). Generally, you only need to pay LCT when you .

http://www.ato.gov.au/businesses/PrintFriendly.aspx?ms=businesses&doc=/content/00205487.htm -

ratio of home mortgage to income

Luxury Car Tax Calculator | LCT for vehicle purchases in Australia ...

In short, Luxury Car Tax is calculated as 33% of the GST exclusive portion of the vehicle purchase price over $59,133. It can be calculated using the following .

http://www.privatefleet.com.au/links-and-resources/crash-tests-car-safety/car-stamp-duty/LCT/

anterior | próxima

Opiniões dos Usuários song verses for sale

Avaliação dos usuários

furnished apartments seattle queen anne

Inputs, outputs, interest, depreciation: take a luxury drive through our ...

Jun 19, 2009 . I found this out recently after an article I did on claiming GST and tax deductions for luxury vehicles. The confusion starts with the fact that there .

http://www.businessday.com.au/small-business/inputs-outputs-interest-depreciation-take-a-luxury-drive-through-our-tax-laws-20090619-cp26.html

anterior | próxima