Detalhes

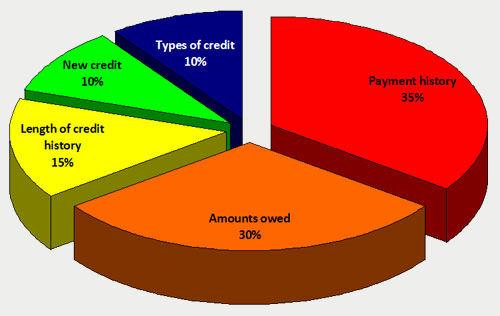

Information Factored in Score

May 31, 2012 . Payment history (approximately 35% of your score is based on this . How much of the total credit line is being used on credit cards and other .

https://help.equifax.com/app/answers/detail/a_id/138/~/information-factored-in-score

Produtos relacionados

shopping uol cadernos-

Credit Reporting and Consumer Credit Scoring

Credit reports and scores are being used for many decisions such as credit . Who is responsible for identifying and correcting errors on your credit report? . How much (proportion of total) of the total credit lines are being used; How much is .

http://www.farmdoc.illinois.edu/finance/consumer_credit/CreditScoring.htm -

my FICO Score - amount owned on accounts

Owing money on credit accounts doesn't necessarily mean you're a high-risk . How much of the total credit line is being used and other "revolving" credit .

http://www.myfico.com/crediteducation/amounts-owed.aspx -

of your total credit being used

How much available credit should a person have via credit cards?

For starters, congrats on being one of those that pays off your credit card each . you are not using - to do so would drop your total credit relative to credit in use.

http://askville.amazon.com/credit-person-cards/AnswerViewer.do?requestId=3038114

-

PrimeLending | Long Beach | Getting Approved | How Your Credit ...

How Your Credit Score is Derived . types of accounts; How much of the total credit line is being used; How much of installment loan accounts is still owed .

https://lo.primelending.com/longbeach/content/getting_approved/how_your_credit_score_is_derived.html -

How To Raise Your Credit Score 100 Points in 45 Days

But if you have card debt of $10,000 and your total credit available is $15,000, you change your ratio to 66% of your available credit being used. The lower the .

http://www.coloradohomegroup.com/raise-your-credit.asp -

Your enhanced Bank of America credit card statement

Use this section of your statement to find your total account balance, as well as . the consequences of missing a payment due date (like being charged a late .

http://learn.bankofamerica.com/articles/managing-credit/your-enhanced-bank-of-america-credit-card-statement.html

-

What are the key factors that affect my - Affordable Credit Repair ...

My name is T. Jeffery and I have been a member over a year now. . how much of the total credit line is being used on credit cards and other "revolving credit" .

http://www.legacylegal.com/whatwedocredit.asp -

stores buy used books vancouver

Does Being Unemployed Have an Impact on Your Credit Scores ...

Feb 10, 2012 . For example, if the total amount you owe on your credit cards is $3,000 and your total credit limit is $10,000, you have used 30 percent of your .

http://www.smartcredit.com/blog/2012/02/10/does-being-unemployed-have-an-impact-on-your-credit-scores/ -

Why some Credit Card Applicatons are Denied and what to do about it

By far the most likely explanation for a credit card applicatoin being denied is a poor . rejected and which particular credit bureau they used to access your report. . of credit you have and the amount you're using, so reducing your total credit .

http://www.celtnet.org.uk/ns/denied-credit-card-application.html

anterior | próxima

Opiniões dos Usuários food shopping venice italy

Avaliação dos usuários

zara guess sale

How do you bring up your credit score

A large number can indicate higher risk of over-extension. How much of the total credit line is being used on credit cards and other "revolving credit" accounts.

http://wiki.answers.com/Q/How_do_you_bring_up_your_credit_score

anterior | próxima